[Company name]

Since XXXX [Firm name], based in [XXXX] has been providing expert advice and accountancy services to the construction sector.

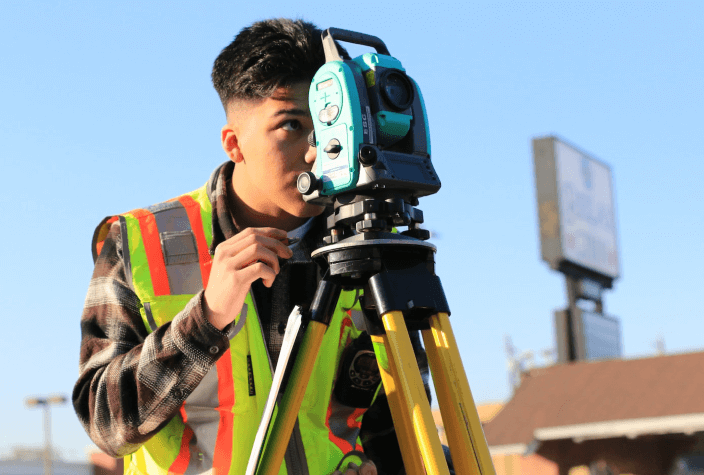

At [insert firm name] we are experts in construction, which can be a complicated industry to operate in.

We have experience in dealing with numerous contractors within [insert location] and across the UK, providing taxation advice specifically regarding the Construction Industry Scheme (CIS).

There can be numerous trades involved in construction, which include:

- Bricklayers

- Carpenters

- Demolition and dismantling

- Electricians

- Groundworkers

- Plumbers

It is important to note that CIS rules still apply even if your business is based outside the UK, but you carry our construction work as a contractor or subcontractor in the UK.

Talk to our team to find out how we can help you with CIS and let us take the hassle away from you.

We can help you with:

- HMRC registration

- Ontime payments within CIS and avoid penalties

- Keep you accounts in order

- Updating you with any changes to CIS